A) $15,000

B) $50,000

C) $45,000

D) $60,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

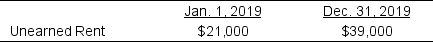

Bruder Realtors always collects rent in advance from its customers. The 2019 income statement for Bruder reports rent revenue of $126,000. Assume all rent is paid in cash. The related balance sheet accounts for the beginning and end of the year were:

Based on this information, the amount of cash collected during 2019 from Bruder's customers was:

Based on this information, the amount of cash collected during 2019 from Bruder's customers was:

A) $159,000

B) $144,000

C) $ 46,800

D) $169,500

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On the last day of December 2019, Dan Matthews Aviators entered into a transaction that resulted in a receipt of $108,000 cash in advance related to services that will be provided during January 2020. During December of 2019, the company also performed $64,000 of services which were neither billed nor paid. Prior to December adjustments and before these two transactions were recorded, the company's trial balance showed service revenue of $1,600,000 at December 31, 2019. There are no other prepaid services yet to be delivered. If Dan Matthews Aviators makes the appropriate adjusting entry, how much will be reported on the December 31, 2019 balance sheet as unearned revenue?

A) $ 64,000

B) $152,000

C) $108,000

D) $ 14,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Portland Fitness Centers have 15,000 members whose monthly dues are $200 each. The company does not send individual bills to customers, who have until the 10th day of the month following the month of service to pay their monthly dues. On December 31, 2019, the company's records show that 7,000 customers have already paid their December dues, and the payments were properly recorded. The adjusting entry to be recorded on December 31 will include:

A) A debit to Accounts Receivable of $1,600,000

B) A debit to Accounts Receivable of $1,400,000

C) A credit to Membership Revenue of $1,400,000

D) A credit to Membership Revenue of $3,000,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Owl Company calculates that interest of $5,400 has accrued at December 31 on outstanding notes payable. How should Owl record this on December 31?

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During July, wage expense of $54,000 was reported on the income statement of Caroline Company. If wages payable on July 1st was $4,000, and wages of $40,000 were paid during July, how much was accrued wages payable on July 31st?

A) $18,000

B) $ 3,000

C) $ 2,000

D) $ 4,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the current accounting period, Ohio Company paid $6,000 for advertising services in advance of receiving them. Prepaid Advertising was debited and Cash was credited for $6,000. At the end of the accounting period, three-fourths of the services paid for had been received. The proper adjusting entry is:

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Williams Company paid $48,000 for a two-year insurance policy on October 1 and recorded the $48,000 as a debit to Prepaid Insurance and a credit to Cash. What adjusting entry should Fred make on December 31, the end of the accounting period (no previous adjustment has been made) ?

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At the end of the accounting period, the Bright Future Company's Service Fees Earned account has a normal balance of $456,000. The accountant makes two adjustments--one to accrue unbilled service fees of $36,000, and the other to reduce the Unearned Service Fees liability account by $5,400. After the adjustments are posted, the Service Fees Earned account has a balance of:

A) $497,400

B) $479,400

C) $432,600

D) $452,400

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pam Harper received $15,000 from a tenant on December 1 for five months' rent of an office. This rent was for December, January, February, March, and April. If Pam debited Cash and credited Unearned Rental Income for $15,000 on December 1, what necessary adjustment would be made on December 31?

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

John Monroe Company borrowed $60,000 from Bank of USA by signing a 6%, 3-month note on September 1. Principal and interest are payable to the bank on December 1. If the company prepares monthly financial statements, the adjusting entry that the company should make for interest on September 30, would be:

A) Debit Note Payable , $3,600; Credit Cash, $3,600

B) Debit Interest Expense, $900; Credit Interest Payable, $900

C) Debit Interest Expense, $3,600; Credit Interest Payable, $3,600

D) Debit Interest Expense, $300; Credit Interest Payable, $300

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

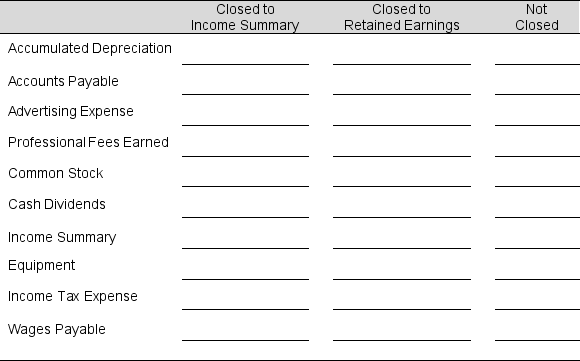

Listed below are selected accounts for Valley Low Corporation. Place an X in the proper column to indicate whether, at the end of the accounting period, the account is (1) closed to the Income Summary account; (2) closed to the Retained Earnings account; or (3) not closed.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During their first year, Adrian & Associates bought $32,000 worth of supplies for their CPA firm. When purchased, the supplies were debited to Supplies and credited to Accounts Payable. What adjusting entry would Adrian & Associates make if $8,000 worth of supplies were on hand at year-end?

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

Selected accounts of The Hogwarts Company are shown below as of January 31 of the current year, before any adjusting entries have been made. Hogwarts' accounting year begins on January 1.

Use the following information to prepare the necessary January 31 adjusting entries:

(1) Prepaid advertising represents advertising for January, February, and March.

(2) January 31 supplies on hand total $2,200.

(3) Test equipment is expected to last 10 years.

(4) Last month the firm received $10,200 of service fees in advance. The firm performed the necessary work during January.

(5) Accrued salaries not recorded at January 31 are $2,000.

Use the following information to prepare the necessary January 31 adjusting entries:

(1) Prepaid advertising represents advertising for January, February, and March.

(2) January 31 supplies on hand total $2,200.

(3) Test equipment is expected to last 10 years.

(4) Last month the firm received $10,200 of service fees in advance. The firm performed the necessary work during January.

(5) Accrued salaries not recorded at January 31 are $2,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following accounts should appear in a post-closing trial balance?

A) Income Summary

B) Accounts Payable

C) Service Fees Earned

D) Depreciation Expense

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Huntley Company paid $52,800 for a four-year insurance policy on September 1 and recorded the $52,800 as a debit to Prepaid Insurance and a credit to Cash. What adjusting entry should Huntley make on December 31, the end of the accounting period (no previous adjustment has been made) ?

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Runner Company calculates it has earned (but not yet collected or recorded) interest of $3,150 at December 31 on outstanding notes receivable. How should Runner record this on December 31?

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Julissa Company pays its employees a total salary of $14,000 every other Friday for 10 days of work (employees do not work or get paid for Saturdays and Sundays) . In a given year, the company's pay days fall on September 26 (Friday) and October 10 (Friday) , and they close their books on September 30. Which of the following pairs of journal entries is correct?

A) Sept 30 Salaries Expense 2,800

Salaries Payable 2,800

Oct 10 Salaries Expense 14,000

Cash 14,000

B) Sept 30 Salaries Expense 2,800

Salaries Payable 2,800

Oct 10 Salaries Payable 2,800

Salaries Expense 11,200

Cash 14,000

C) Sept 30 Salaries Expense 2,800

Salaries Payable 2,800

Oct 10 Salaries Payable 5,600

Salaries Expense 8,400

Cash 14,000

D) Sept 30 Salaries Expense 2,800

Cash 2,800

Oct 10 Salaries Expense 11,200

Cash 11,200

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Casden Company paid $48,000 in insurance premiums during 2019. Their financial statements showed $8,000 in prepaid insurance on its Balance Sheet as of December 31, 2018 and $12,000 on its Balance Sheet as of December 31, 2019. The insurance expense to be reported on the income statement for 2019 should be:

A) $57,000

B) $40,800

C) $44,000

D) $51,600

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Yellow Apple Company's Printing Supplies account had a beginning balance of $3,000. During the month, purchases of printing supplies totaling $2,250 were debited to the Printing Supplies account. If $1,500 worth of printing supplies is still on hand at month-end, what is the proper adjusting entry?

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 167

Related Exams