B) False

Correct Answer

verified

Correct Answer

verified

True/False

Even if the correlation between the returns on two securities is +1.0, if the securities are combined in the correct proportions, the resulting 2-asset portfolio will have less risk than either security held alone.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Because of differences in the expected returns on different investments, the standard deviation is not always an adequate measure of risk. However, the coefficient of variation adjusts for differences in expected returns and thus allows investors to make better comparisons of investments' stand-alone risk.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock A has a beta = 0.8, while Stock B has a beta = 1.6. Which of the following statements is CORRECT?

A) Stock B's required return is double that of Stock A's.

B) If the marginal investor becomes more risk averse, the required return on Stock B will increase by more than the required return on Stock A.

C) An equally weighted portfolio of Stocks A and B will have a beta lower than 1.2.

D) If the marginal investor becomes more risk averse, the required return on Stock A will increase by more than the required return on Stock B.

E) If the risk-free rate increases but the market risk premium remains constant, the required return on Stock A will increase by more than that on Stock B.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nile Food's stock has a beta of 1.4, while Elba Eateries' stock has a beta of 0.7. Assume that the risk-free rate, rRF, is 5.5% and the market risk premium, (rM − rRF) , equals 4%. Which of the following statements is CORRECT?

A) If the risk-free rate increases but the market risk premium remains unchanged, the required return will increase for both stocks but the increase will be larger for Nile since it has a higher beta.

B) If the market risk premium increases but the risk-free rate remains unchanged, Nile's required return will increase because it has a beta greater than 1.0 but Elba's required return will decline because it has a beta less than 1.0.

C) Since Nile's beta is twice that of Elba's, its required rate of return will also be twice that of Elba's.

D) If the risk-free rate increases while the market risk premium remains constant, then the required return on an average stock will increase.

E) If the market risk premium decreases but the risk-free rate remains unchanged, Nile's required return will decrease because it has a beta greater than 1.0 and Elba's will also decrease, but by more than Nile's because it has a beta less than 1.0.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Someone who is risk averse has a general dislike for risk and a preference for certainty. If risk aversion exists in the market, then investors in general are willing to accept somewhat lower returns on less risky securities. Different investors have different degrees of risk aversion, and the end result is that investors with greater risk aversion tend to hold securities with lower risk (and therefore a lower expected return) than investors who have more tolerance for risk.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If investors become less averse to risk, the slope of the Security Market Line (SML) will increase.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wei Inc. is considering a capital budgeting project that has an expected return of 25% and a standard deviation of 30%. What is the project's coefficient of variation?

A) 1.20

B) 1.26

C) 1.32

D) 1.39

E) 1.46

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) An investor can eliminate virtually all market risk if he or she holds a very large and well diversified portfolio of stocks.

B) The higher the correlation between the stocks in a portfolio, the lower the risk inherent in the portfolio.

C) It is impossible to have a situation where the market risk of a single stock is less than that of a portfolio that includes the stock.

D) Once a portfolio has about 40 stocks, adding additional stocks will not reduce its risk by even a small amount.

E) An investor can eliminate virtually all diversifiable risk if he or she holds a very large, well diversified portfolio of stocks.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock A has a beta of 0.7, whereas Stock B has a beta of 1.3. Portfolio P has 50% invested in both A and B. Which of the following would occur if the market risk premium increased by 1% but the risk- free rate remained constant?

A) The required return on Portfolio P would increase by 1%.

B) The required return on both stocks would increase by 1%.

C) The required return on Portfolio P would remain unchanged.

D) The required return on Stock A would increase by more than 1%, while the return on Stock B would increase by less than 1%.

E) The required return for Stock A would fall, but the required return for Stock B would increase.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Diversification will normally reduce the riskiness of a portfolio of stocks.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that the risk-free rate is 5%. Which of the following statements is CORRECT?

A) If a stock has a negative beta, its required return under the CAPM would be less than 5%.

B) If a stock's beta doubled, its required return under the CAPM would also double.

C) If a stock's beta doubled, its required return under the CAPM would more than double.

D) If a stock's beta were 1.0, its required return under the CAPM would be 5%.

E) If a stock's beta were less than 1.0, its required return under the CAPM would be less than 5%.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Inflation, recession, and high interest rates are economic events that are best characterized as being

A) systematic risk factors that can be diversified away.

B) company-specific risk factors that can be diversified away.

C) among the factors that are responsible for market risk.

D) risks that are beyond the control of investors and thus should not be considered by security analysts or portfolio managers.

E) irrelevant except to governmental authorities like the Federal Reserve.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Beta is measured by the slope of the security market line.

B) If the risk-free rate rises, then the market risk premium must also rise.

C) If a company's beta is halved, then its required return will also be halved.

D) If a company's beta doubles, then its required return will also double.

E) The slope of the security market line is equal to the market risk premium, (rM − rRF) .

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

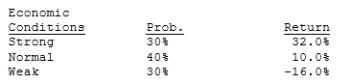

Magee Inc.'s manager believes that economic conditions during the next year will be strong, normal, or weak, and she thinks that the firm's returns will have the probability distribution shown below. What's the standard deviation of the estimated returns? (Hint: Use the formula for the standard deviation of a population, not a sample.)

A) 17.69%

B) 18.62%

C) 19.55%

D) 20.52%

E) 21.55%

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

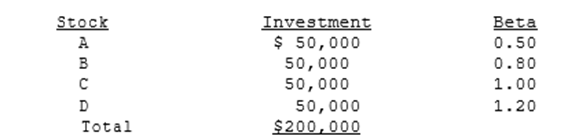

Kristina Raattama holds a $200,000 portfolio consisting of the following Stocks. The portfolio's beta is 0.875.

If Kristina replaces Stock A with another stock, , which has a beta of 1.50, what will the portfolio's new beta be?

If Kristina replaces Stock A with another stock, , which has a beta of 1.50, what will the portfolio's new beta be?

A)

B)

C)

D)

E)

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stocks A and B each have an expected return of 15%, a standard deviation of 20%, and a beta of 1.2. The returns on the two stocks have a correlation coefficient of +0.6. You have a portfolio that consists of 50% A and 50% B. Which of the following statements is CORRECT?

A) The portfolio's beta is less than 1.2.

B) The portfolio's expected return is 15%.

C) The portfolio's standard deviation is greater than 20%.

D) The portfolio's beta is greater than 1.2.

E) The portfolio's standard deviation is 20%.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Since the market return represents the expected return on an average stock, the market return reflects a certain amount of risk. As a result, there exists a market risk premium, which is the amount over and above the risk-free rate, that is required to compensate stock investors for assuming an average amount of risk.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In portfolio analysis, we often use ex post (historical) returns and standard deviations, despite the fact that we are really interested in ex ante (future) data.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If investors are risk averse and hold only one stock, we can conclude that the required rate of return on a stock whose standard deviation is 0.21 will be greater than the required return on a stock whose standard deviation is 0.10. However, if stocks are held in portfolios, it is possible that the required return could be higher on the stock with the low standard deviation.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 132

Related Exams